Software amortization rules are a complex but essential aspect of accounting for software assets. Understanding these rules can help businesses maximize tax benefits, optimize financial reporting, and make informed decisions about software investments. This comprehensive guide will delve into the intricacies of software amortization, providing a clear understanding of its purpose, methods, tax implications, and practical considerations.

Amortizing software assets involves spreading their cost over their useful life, which is typically determined by their expected lifespan and technological obsolescence. By allocating the cost of software over multiple periods, businesses can match expenses with the revenue generated by the software, providing a more accurate representation of their financial performance.

Software Amortization: Software Amortization Rules

Software amortization is the process of spreading the cost of a software asset over its useful life. This is done by allocating a portion of the software’s cost to each period in which it is used.

The purpose of software amortization is to match the expense of the software to the periods in which it is used. This provides a more accurate picture of the company’s financial performance and can help to avoid overstating profits in the early years of the software’s life.

Software Assets that Can Be Amortized

Not all software assets can be amortized. Only software that is expected to be used over a period of more than one year can be amortized. Examples of software assets that can be amortized include:

- Operating systems

- Database software

- Application software

Accounting Treatment of Software Amortization

Software amortization is the process of allocating the cost of a software asset over its useful life. This is done to match the expense of the software to the periods in which it is used.

The accounting principles governing software amortization are as follows:

- Software assets must be capitalized if they meet the definition of an asset.

- Software assets must be amortized over their useful life.

- The useful life of a software asset is the period over which it is expected to be used.

Methods of Calculating Amortization

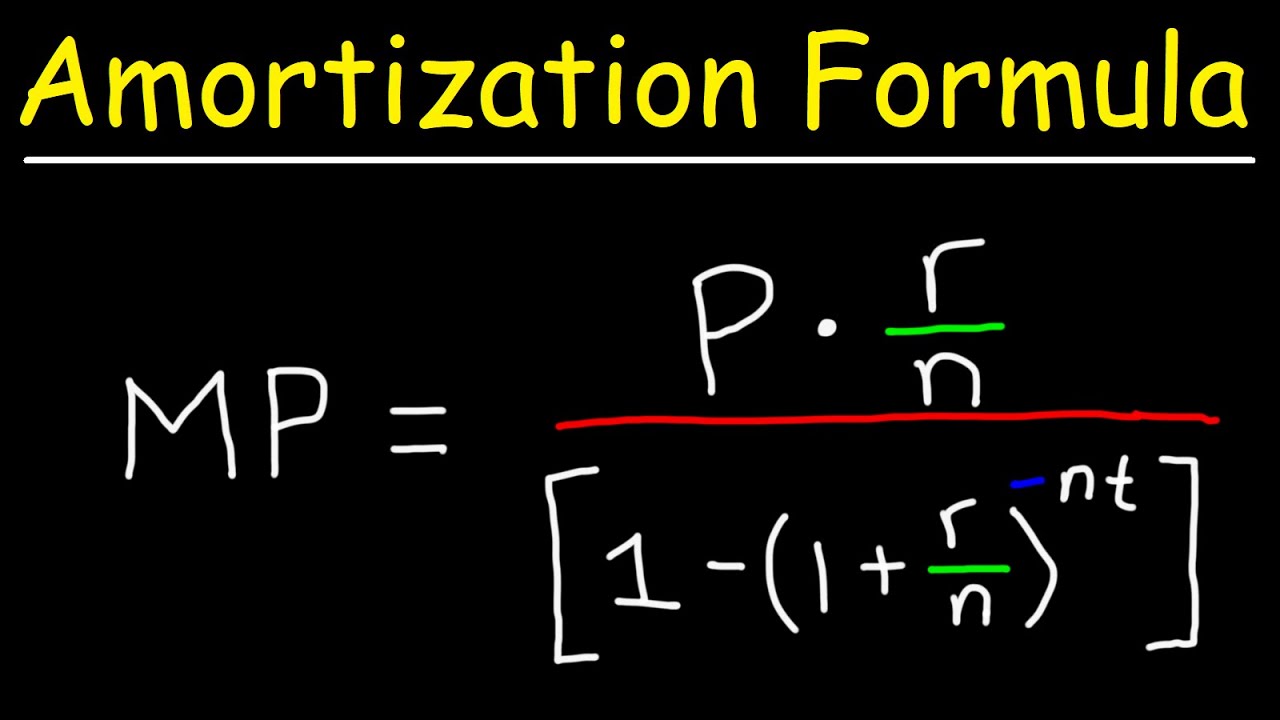

There are two common methods of calculating amortization: straight-line and declining balance.

Straight-line amortization allocates the cost of the software asset evenly over its useful life. This method is simple to apply and results in a constant amortization expense each period.

Declining balance amortization allocates a larger portion of the cost of the software asset to the early years of its useful life. This method results in a higher amortization expense in the early years and a lower amortization expense in the later years.

Determining the Useful Life of Software Assets

The useful life of a software asset is the period over which it is expected to be used. This period can be difficult to determine, as it depends on a number of factors, including:

- The expected technological life of the software

- The expected economic life of the software

- The expected usage patterns of the software

In general, the useful life of a software asset is shorter than the technological life of the software. This is because software assets are often replaced before they become obsolete.

Tax Implications of Software Amortization

The tax treatment of software amortization varies across different jurisdictions, influencing the taxable income of businesses. Understanding these implications is crucial for optimizing tax benefits related to software amortization.

In many jurisdictions, software is considered an intangible asset and is subject to amortization over its useful life. Amortization expenses reduce the taxable income of a business, resulting in lower tax liability.

Impact on Taxable Income

- Amortization expenses are deducted from the taxable income of a business, reducing the amount of income subject to taxation.

- The useful life of software is typically determined by its expected period of use, which can vary depending on the industry and specific software.

- The amortization period is spread over the useful life of the software, with a portion of the cost being expensed each year.

Strategies for Optimizing Tax Benefits

- Choosing the Right Amortization Method:Different amortization methods, such as straight-line or accelerated depreciation, can impact the timing of tax deductions.

- Maximizing Amortization Deductions:Businesses can optimize tax benefits by ensuring that all eligible software expenses are properly identified and amortized.

- Reviewing Software Useful Life:Regularly reviewing the useful life of software can ensure that amortization expenses are aligned with its actual usage and avoid over- or under-amortization.

Practical Considerations for Software Amortization

Implementing and managing software amortization policies requires careful planning and attention to detail. By following best practices, organizations can ensure accuracy and consistency in their amortization calculations, minimize challenges, and leverage technology to streamline the process.

One best practice is to establish a clear and comprehensive amortization policy that Artikels the specific rules and procedures to be followed. This policy should include details such as the amortization method, the useful life of software assets, and the treatment of software upgrades and enhancements.

Common Challenges and Pitfalls

One common challenge in managing software amortization is determining the useful life of software assets. This can be difficult to estimate, especially for rapidly evolving software technologies. Another challenge is tracking software upgrades and enhancements, which may need to be capitalized or expensed depending on their significance.

Role of Technology and Automation

Technology can play a significant role in streamlining the software amortization process. Automated software amortization tools can help organizations track software assets, calculate amortization expenses, and generate amortization schedules. This can save time and reduce the risk of errors.

Comparison of Software Amortization Rules Across Industries

The amortization rules for software can vary significantly across different industries. This is due to a number of factors, including the nature of the software, the industry’s accounting practices, and the tax laws applicable to the industry.

In general, software is considered an intangible asset and is subject to amortization over its useful life. The useful life of software can vary depending on the type of software and the industry in which it is used. For example, software that is used for mission-critical applications may have a shorter useful life than software that is used for general administrative purposes.

Factors Influencing Variations in Amortization Practices

There are a number of factors that can influence variations in amortization practices across industries. These factors include:

- The nature of the software

- The industry’s accounting practices

- The tax laws applicable to the industry

Trends and Emerging Issues in Software Amortization, Software amortization rules

There are a number of trends and emerging issues in software amortization. These include:

- The increasing use of cloud-based software

- The adoption of new accounting standards

- The changing tax laws applicable to software

Case Studies and Examples of Software Amortization

In the realm of accounting and finance, the amortization of software expenses offers valuable insights into real-world business scenarios and their impact on financial decision-making. Let’s delve into case studies and examples that showcase the practical application of software amortization rules.

One notable case study involves a software development company that incurred significant expenses in developing and acquiring new software. To accurately reflect the value of this asset over its useful life, the company opted to amortize the software expenses over a period of five years.

This approach allowed the company to spread the cost of the software over its expected lifespan, providing a more accurate representation of its financial performance and reducing the impact on its income statement in any given year.

Impact on Financial Statements

The amortization of software expenses directly affects the company’s financial statements. By allocating the cost of the software over its useful life, the company reduces the initial impact on its income statement. This can lead to a more stable and consistent financial performance over time, as the cost of the software is spread out evenly rather than being recognized in a single period.

Moreover, software amortization can impact the company’s balance sheet. The initial cost of the software is recorded as an asset, and as amortization occurs, the value of the asset decreases over time. This reduction in asset value is reflected in the company’s financial statements, providing a more accurate picture of its financial health.

Decision-Making and Best Practices

Understanding the impact of software amortization is crucial for informed decision-making. By carefully considering the useful life of the software and the appropriate amortization period, companies can ensure that the cost of the software is appropriately allocated and reflected in their financial statements.

Best practices in software amortization include conducting thorough research to determine the software’s useful life, considering industry standards and guidelines, and seeking professional advice from accountants or financial experts to ensure compliance with accounting principles.

Final Summary

In conclusion, software amortization rules play a critical role in managing software assets and ensuring accurate financial reporting. By understanding and implementing these rules effectively, businesses can optimize their tax benefits, streamline accounting processes, and make informed decisions about software investments.

As technology continues to evolve and software becomes an increasingly integral part of business operations, the importance of software amortization will only continue to grow.

Key Questions Answered

What is the purpose of software amortization?

Software amortization allows businesses to spread the cost of software assets over their useful life, matching expenses with the revenue generated by the software.

What are the different methods of calculating software amortization?

Common methods include straight-line, declining balance, and units-of-production.

How does software amortization impact taxable income?

Amortization expenses reduce taxable income, potentially resulting in tax savings.

What are some best practices for implementing software amortization policies?

Establish clear policies, document amortization schedules, and use technology to streamline the process.